td ameritrade tax withholding

985 003 031 YTD Return. Im rolling some cash from my traditional IRA into my Roth and one of the fields is for Tax Withholding Election for federal withholding and then state.

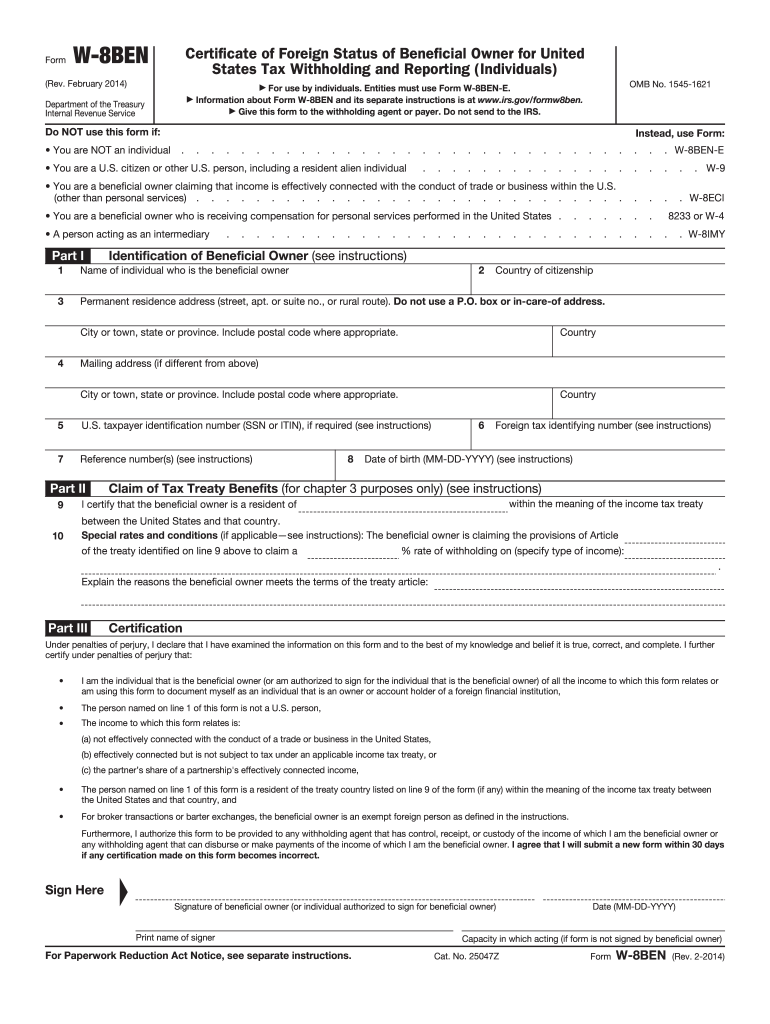

Td Ameritrade W8ben Fill Online Printable Fillable Blank Pdffiller

Source Income Subject to Withholding.

. If applicable you are also certifying that as a US. Ad The Industry-Wide Leader in Mobile Trading. Internal Revenue Service IRS on your behalf so no additional tax is due after.

Using TD Ameritrade Taxes. This section is very useful for information about reportable transactions tax documents availability tax reporting questions and RMD calculations just to name a few. Taxpayer with at least 10 in dividend income youll receive a 1099-DIV form from TD Ameritrade along with a consolidated 1099 form.

1042-S Foreign Persons US. I recently opened an account with TD Ameritrade. Make taxes a little less taxing.

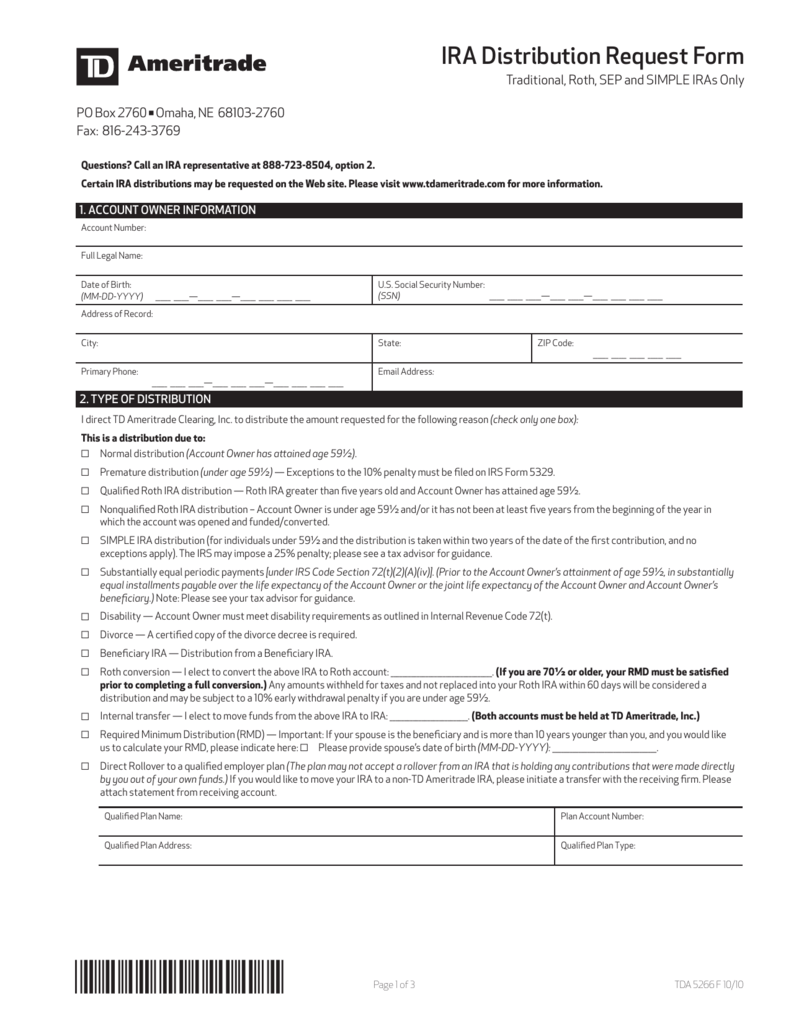

Before being acquired by Charles Schwab TD Ameritrade was an American online broker based in Omaha Nebraska that grew rapidly through acquisition to become the 746th-largest US. Claim exemption from backup withholding if you are a US. Any withdrawal from your Custodial IRA is subject to federal income tax withholding unless you elect not to have withholding apply.

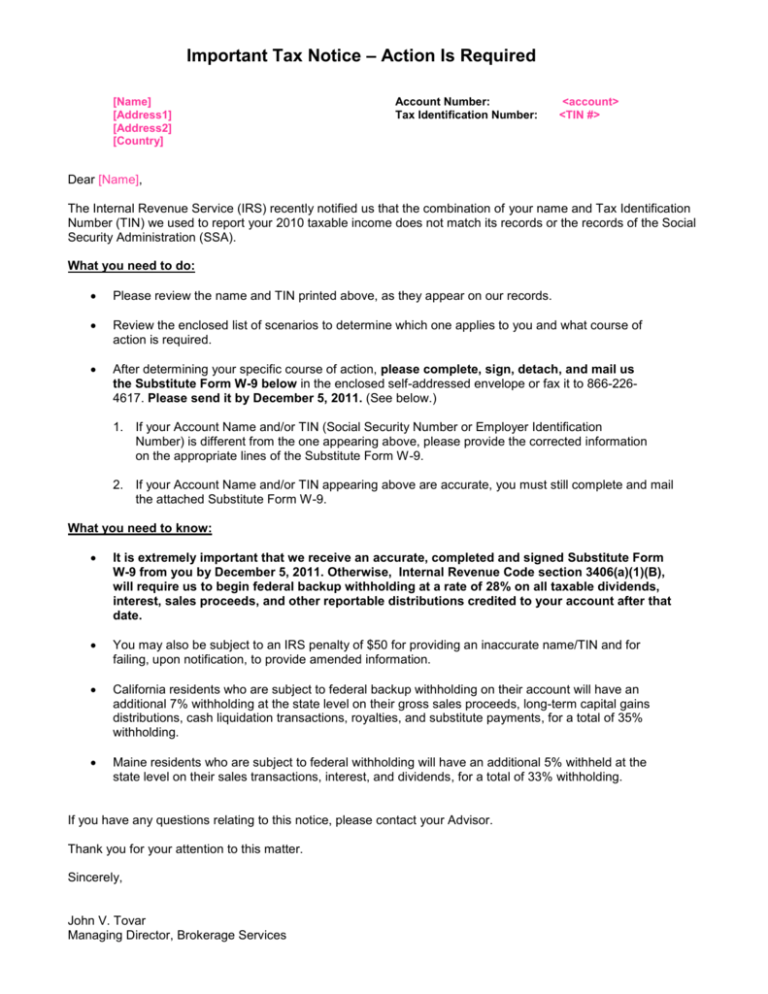

A MandatoryState Income Tax Withholding When Federal Income Tax is Withheld. One way to optimize your withholding is to use the IRS Tax Withholding Estimator. If youre a US.

JPMorgan Muni National Interm. This is Non-Resident Alien NRA withholding that is withheld by TD Ameritrade Singapore and sent to the US. TD Ameritrade Clearing Inc.

Is required by federal andor state statutes to withhold a percentage of your IRA Distribution for income tax purposes. Not Available through TD Ameritrade. TD Ameritrade will report a dividend as qualified if it has been paid by a US.

You must elect to withhold state income tax when federal income tax is withheld. Withholding will apply to the entire withdrawal since the. If you do not make an election we will.

There are a few events that may cause you to consider a tax withholding adjustment. Today 945 AM ET MarketWatch Print. In some cases you may elect not.

Do I need to report anything on my tax return if I havent withdrawn any funds from the account. Withholding will apply to the entire withdrawal since the entire withdrawal may be included in your income that is subject to federal income tax. State Withholding If you change the state of residence listed on your account you will be responsible for any state withholding tax implications.

TD Ameritrade Secure Log-In for online stock trading and long term investing clients. Sign Up from Your phone. Before being acquired by Charles Schwab TD Ameritrade was an American online broker based in Omaha Nebraska that grew rapidly through acquisition to become the 746th-largest US.

TD Ameritrades tax information guide helps simplify the process so that tax season can be a little less taxing. Maine residents who are subject to federal withholding will have an additional 5 withheld at the state level on their sales transactions interest and dividends for a total of 33 withholding. Person your allocable share of any partnership income from a US.

How much of your salary is withheld from. JPMorgan Tax Aware Real Return Fund Class R6 TXRRX. Holding period requirements that must be met to be eligible for this lower tax rate.

The tax rate schedules for individuals are shown on page 4. Or qualified foreign corporation. Ad The Industry-Wide Leader in Mobile Trading.

Sign Up from Your phone. You must enter the gain or. You can use your.

The key to filing taxes is being prepared. You may elect not to have withholding apply to. For planning purposes focus on your marginal tax rate the rate that applies to your last dollar of taxable income.

Fill Free Fillable Td Ameritrade Pdf Forms

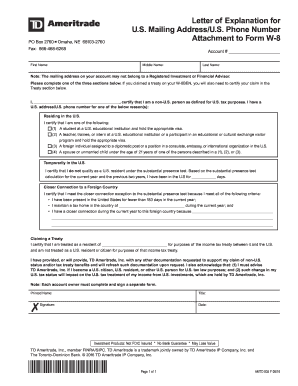

How To Open A Td Ameritrade Account Outside Of The Us As A Non Resident Alien Katie Scarlett Needs Money

Non U S Resident How To Trade Stocks In An Internat Ticker Tape

Fill Free Fillable Td Ameritrade Pdf Forms

Fill Free Fillable Td Ameritrade Pdf Forms

Logo Td Ameritrade Institutional

Fill Free Fillable Td Ameritrade Pdf Forms

1040s 1099s Other Federal Tax Forms What You Mig Ticker Tape

What Are Qualified Dividends And Ordinary Dividends Ticker Tape

Fill Free Fillable Td Ameritrade Pdf Forms

Fillable Online View Td Ameritrade Fax Email Print Pdffiller

Td Ameritrade Letter Of Explanation Fill Online Printable Fillable Blank Pdffiller

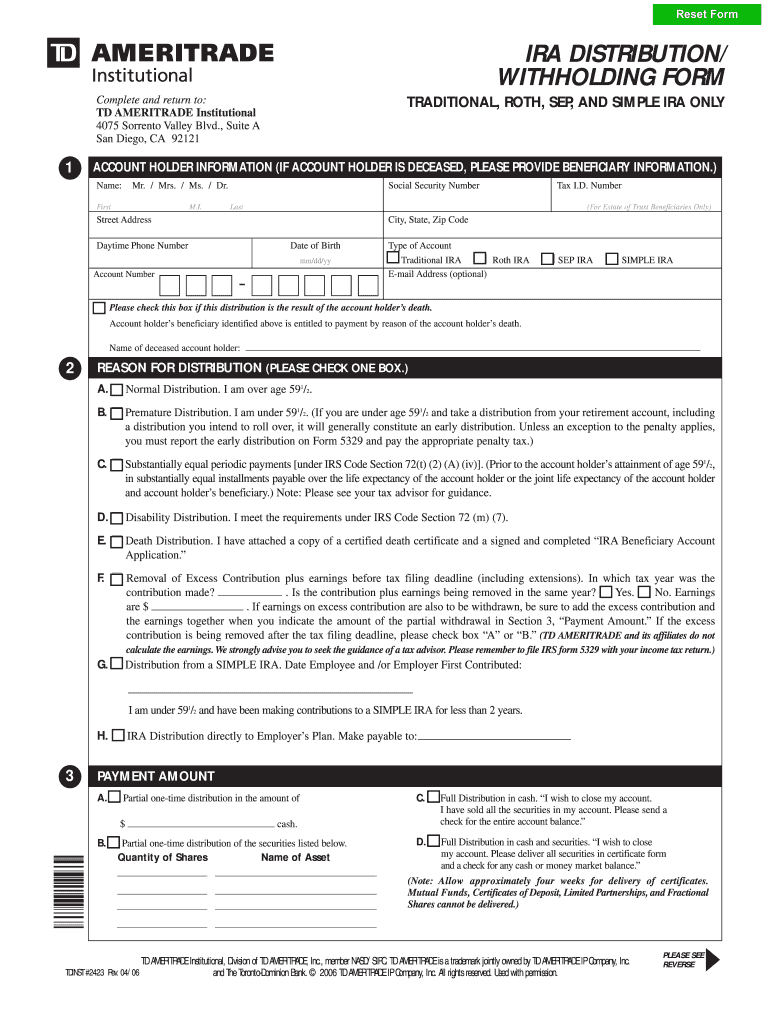

Ameritrade Ira Distribution Withholding Form Fill Online Printable Fillable Blank Pdffiller